When Money Fails, Military Force Reigns Supreme

In the modern world, money isn't mined from the earth or backed by tangible assets like gold, it’s created out of thin air by central banks and governments.

This fiat system, where currency derives its value from decree rather than intrinsic worth, underpins global economies.

But what happens when that trust erodes? When does money become "fake," and what truly sustains it?

As history shows, and as the elite at the helm of power well understand, the answer often boils down to force, military might, coercion, and the ability to enforce value through dominance.

In 2026, this reality is starkly illustrated by the United States under President Donald Trump, whose aggressive foreign policies signal the desperate throes of a crumbling empire.

Drawing on recent data and events, we explore the fragility of fiat money, the role of military power, and how America's actions reflect broader global shifts.

Fiat money, from the Latin for "let it be done," is currency issued by governments without backing from physical commodities.

The U.S. dollar, the euro, and most global currencies fall into this category. Central banks like the Federal Reserve create money through mechanisms such as quantitative easing (printing money to buy assets) or adjusting interest rates to influence lending.

For instance, during economic crises, the Fed can inject trillions into the system overnight, as it did in 2020 with over $3 trillion in response to COVID-19.

This process isn't magic, it’s a deliberate policy tool. Banks lend out far more than they hold in reserves (fractional reserve banking), multiplying the money supply.

In 2025, the U.S. money supply (M2) stood at approximately $21 trillion, up from $15 trillion pre-pandemic, fueling inflation concerns.

The reality? Money is a social construct, sustained by collective belief in its value for transactions, taxes, and debt repayment.

Money becomes "fake" when that belief shatters, through hyperinflation, loss of confidence, or systemic collapse.

Hyperinflation occurs when governments print excessively to cover debts, eroding purchasing power.

Classic examples include Weimar Germany (1923), where prices doubled every few days, or Zimbabwe (2008), with inflation peaking at 79.6 billion percent monthly.

In 2026, global inflation is easing but uneven, the IMF projects it falling to 5.8% worldwide, yet U.S. inflation lingers above target at around 3%, delayed by policy shifts.

The U.S. national debt hit $38.4 trillion in January 2026, growing by $2.25 trillion in the past year alone, equivalent to borrowing $8 billion daily.

Interest payments on this debt are projected to exceed $1 trillion annually by year's end, surpassing defense spending and rivaling Social Security outlays.

When faith in this sytem fails, alternatives emerge. Cryptocurrencies like Bitcoin, once dismissed, now challenge fiat as stores of value, with global adoption rising amid distrust in central banks.

In hyperinflation scenarios, people revert to bartering or foreign currencies, Zimbabweans used U.S. dollars informally for years.

What prevents total collapse? Often, external intervention or regime change, but underlying it all is force, governments enforce tax payments in their currency, backed by legal and military coercion.

At its core, fiat money's value isn't just economic, it’s geopolitical. The "guys at the top" know this. Currencies like the U.S. dollar maintain dominance through military power and global influence.

The dollar's status as the world's reserve currency (held in about 58% of global reserves, was 70%) isn't accidental, it's enforced by U.S. military hegemony, which ensures oil trades in dollars (the petrodollar system) and sanctions non-compliant nations.

Global military spending hit $2.7 trillion in 2024, projected to reach $4.7–6.6 trillion by 2035 if trends continue.

The U.S. leads with $831 billion annually(soon to rise to 1.5trilltion), more than the next nine countries combined, funding 800+ overseas bases and interventions that protect dollar supremacy.

China follows at $303 billion, signaling a multipolar shift.

Elites, central bankers, policymakers, and billionaires, grasp this interplay. At the 2026 Davos World Economic Forum, themes of "geoeconomic confrontation" dominated, with risks like misinformation and polarization topping short-term threats.

They know fiat's fragility, without enforcement, it's worthless paper.

In 2026, these dynamics manifest in U.S. policies under Trump, whose "America First" agenda, now dubbed imperialist by critics, reveals imperial desperation.

Trump's National Security Strategy revives the Monroe Doctrine as the "Donroe Doctrine," asserting dominance in the Western Hemisphere through force.

Key events:

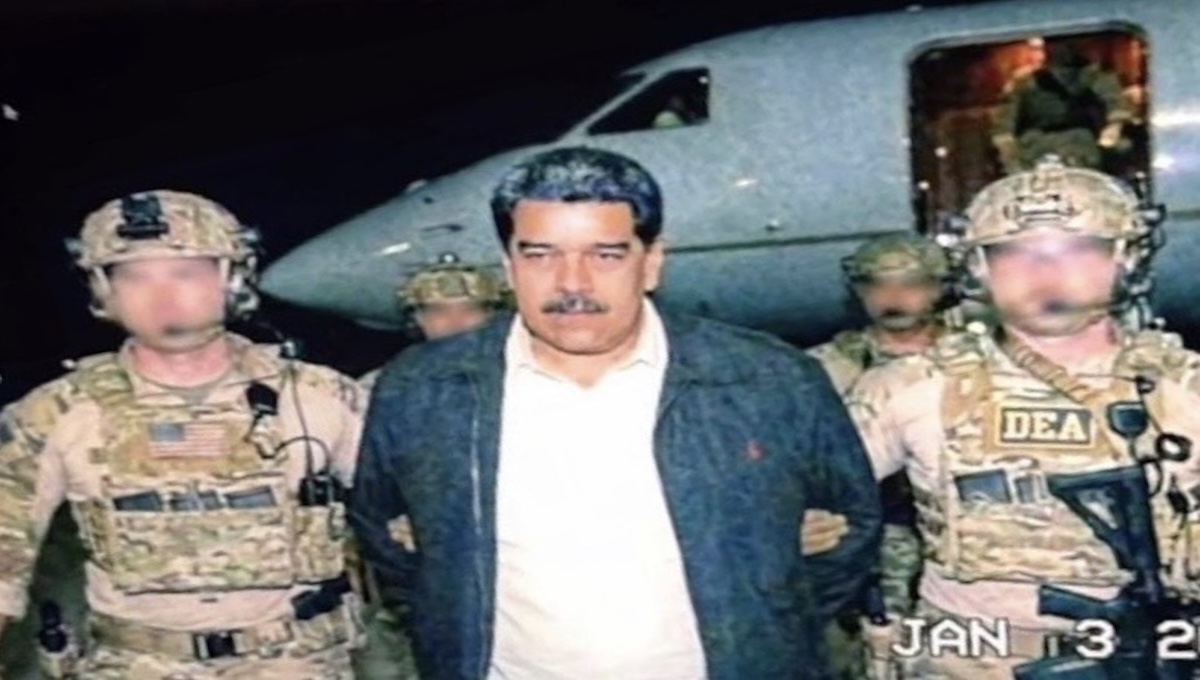

- Venezuela Invasion (January 2026): U.S. forces captured President Nicolás Maduro, claiming Venezuelan oil reserves. This echoes 19th-century gunboat diplomacy, but polls show mixed support, 38.9% approve, 46.4% disapprove. It's framed as combating drugs and securing resources, yet it highlights overreach amid declining influence.

- Greenland Threats: Trump demanded "total access" to Greenland, threatening force against NATO ally Denmark. A vague "framework" deal emerged, but it strains alliances. This territorial grab signals weakness, not strength—empires expand aggressively when core power wanes.

- Withdrawals and Isolationism: The U.S. exited 66 international organizations and the UN climate treaty, ceding influence to China and Russia. In Europe, Trump delegates defense, risking NATO fractures.

These actions tie directly to money's reality. With debt at 100% of GDP ($28.7 trillion economy), the U.S. borrows $2.25 trillion yearly.

Trump's tariffs and resource grabs aim to bolster the dollar, but they accelerate de-dollarization, BRICS nations increasingly trade in yuan or euros.

Historians like Alfred McCoy warn of U.S. decline, militarism abroad mirrors domestic instability, as in Venezuela's capture amid internal U.S. polarization.

Eurasia Group's 2026 risks rank U.S. political revolution #1, with empire unwinding its global order.

Globally, 2026 is turbulent. The IMF forecasts 3.3% growth, but downside risks include tech reevaluations and geopolitics.

China's economy (30% larger than U.S. by purchasing power) drives multipolarity.

World population hits 8.1 billion, with India overtaking China as most populous.

Environmental crises loom. Ocean impacts cost nearly double carbon emissions, with water bankruptcy in many regions.

*(“Water bankruptcy in many regions" refers to a concept recently formalized in a major United Nations University (UNU-INWEH) flagship report released on January 20, 2026, titled Global Water Bankruptcy: Living Beyond Our Hydrological Means in the Post-Crisis Era. The report, led by Kaveh Madani (director of UNU-INWEH), declares that the world has entered an era of global water bankruptcy due to decades of unsustainable water use, pollution, deforestation, soil degradation, groundwater over-extraction, and climate change impacts.)

Geopolitical fragmentation driven by intensifying U.S., China Russia rivalry continues to fuel major global risks, according to the World Economic Forum's 2026 Global Risks Report.

With 68% of respondents expecting a multipolar or fragmented world order in the coming decade, geoeconomic confrontation has become the top near-term threat, raising the odds of interstate conflict, economic weaponization, and declining international cooperation.

Empires historically decline gradually before collapsing suddenly, as demonstrated by Rome, the British Empire, and the Soviet Union.

The United States now displays many of the same warning signs, military overextension exemplified by the 2026 Venezuela intervention, unsustainable national debt growth, and deepening inequality that widens the rich-poor divide.

Strikingly, analyses such as Sir John Glubb's The Fate of Empires place the average lifespan of great powers around 250 years exactly the age the United States reaches in 2026, marking what many regard as a symbolic and potentially decisive tipping point.

The powerful have long understood that the apparent strength of fiat money ultimately rests on force, not intrinsic value.

Trump's 2026 maneuvers seizing Venezuelan oil resources, issuing territorial threats against allies such as Denmark over Greenland, and withdrawing from dozens of multilateral commitments reveal an empire struggling to maintain relevance as debt soars and peer competitors rise.

These actions, however, risk hastening decline by alienating partners and accelerating de-dollarization trends already underway. While global economic growth holds steady for the moment, uncertainty dominates the outlook.

2026 stands as a pivotal year, the unfolding shift could evolve into a more balanced multipolar order if coercive tactics eventually give way to genuine cooperation, or it could spiral into greater chaos if confrontation continues to prevail.

Kai Tutor | The Societal News Team 23JAN2026