Seizing Russian Assets and the Debasement of the Dollar

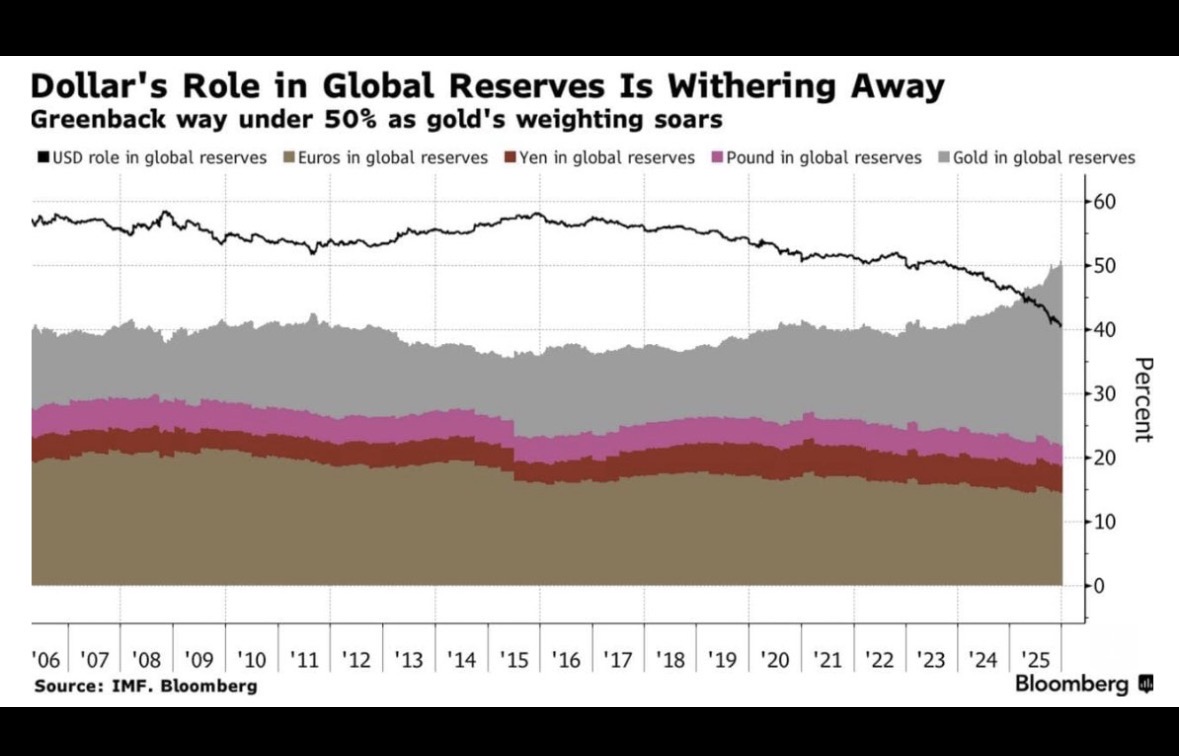

The U.S. dollar's dominance as a reserve currency, holding about 58% of global foreign exchange reserves, is underpinned by its liquidity, the robustness of U.S. markets, and the petrodollar arrangement, where oil trades are predominantly settled in dollars.

This system, formalized in the 1970s through U.S.-Saudi agreements, ensures sustained demand for dollars by linking them to global energy markets.

However, the 2022 freezing of approximately $300 billion in Russian assets by the U.S. and allies has amplified concerns over the dollar's vulnerability to political exploitation, prompting diversification away from it.

Recent developments, like the U.S. military operation in Venezuela leading to Maduro's capture, underscore how these financial tactics intersect with resource geopolitics.

Venezuela, possessing the world's largest proven oil reserves, has long challenged the petrodollar by attempting to trade oil in alternative currencies and cryptocurrencies.

Catalyst for De-Dollarization

In response to Russia's 2022 invasion of Ukraine, Western nations immobilized Russian reserves held abroad, a move that prevented access without constituting outright confiscation.

By 2025, proposals to utilize interest from these assets for Ukrainian aid had materialized, intensifying perceptions of financial theft among non-aligned states.

This action signaled that sovereign assets could be leveraged as geopolitical tools, eroding trust in the dollar system.

Nations like China, India, and Russia responded by accelerating bilateral trade in local currencies. For instance, China-Russia trade reached 90% non-dollar settlements by 2025, while India utilized rupee-ruble mechanisms for Russian oil imports.

BRICS summits emphasized alternative payment systems, viewing the freeze as evidence that non-compliance with Western policies could result in asset expropriation.

Empirically, the dollar's reserve share dipped from 60% in 2021 to 58% by late 2025, with increased gold and renminbi(China’s Yen) holdings reflecting diversification strategies.

Oil Hegemony

The petrodollar system relies on oil-exporting nations recycling surpluses into dollar-denominated assets, sustaining global demand for the currency.

Challenges to this, such as OPEC's occasional euro-pricing discussions or Russia's non-dollar oil deals, threaten U.S. economic leverage.

The Russian asset freeze amplified these risks by demonstrating the dollar's weaponization, prompting oil-rich nations to seek alternatives and thereby debasing the dollar's appeal.

Venezuela's policies under Maduro exemplified this threat. Since 2017, Caracas has pursued oil sales in euros, yuan, and the petro cryptocurrency to circumvent U.S. sanctions, directly undermining petrodollar exclusivity.

Alliances with Russia and China further facilitated non-dollar transactions, aligning with broader de-dollarization post the Russian freeze.

Scholars argue that such moves represent an existential challenge to U.S. financial dominance, as they erode the implicit guarantee of dollar stability tied to oil markets.

U.S. Intervention in Venezuela

The January 3, 2026, U.S. operation capturing Maduro and his wife, Cilia Flores, in Caracas marks a direct escalation, framed officially as enforcement against drug trafficking but intertwined with oil geopolitics.

President Trump explicitly linked the action to assuming control of Venezuela's oil, inviting U.S. companies to invest in its infrastructure. This intervention can be seen as a response to the debasement pressures initiated by the Russian asset freeze, which accelerated global shifts away from the dollar.

By securing Venezuela's reserves, estimated at 300 billion barrels or $17 Trillion usd, the U.S. aims to reinforce the petrodollar by ensuring oil flows remain dollar-denominated, countering de-dollarization trends.

Maduro's regime, through its resistance to U.S. sanctions and non-dollar oil sales, exemplified the risks posed by such diversification, making it a target amid heightened fears post-Russia.

Analyses suggest this capture revives petrodollar debates, as controlling Venezuelan oil could recycle petrodollars into U.S. assets, stabilizing reserve demand.

The 2022 Russian asset freeze has debased the dollar by fostering de-dollarization, creating a feedback loop that incentivizes U.S. actions like the 2026 Maduro capture to control Venezuelan oil and sustain the petrodollar.

Kai Tutor | The Societal News Team 07JAN2026