America's 2026 Economy Is More Fragile Than 2008

The U.S. economy in early 2026 stands at a crossroads, with superficial indicators of stability belied by deep-seated imbalances.

While GDP growth persists and unemployment remains relatively low, these metrics obscure escalating debt levels, persistent inflation, and a devalued currency resulting from over a decade of expansionary monetary policy.

The current economic conditions are worse than those during the 2008 financial crisis, characterized by a housing bubble and banking failures, due to the accumulation of unresolved issues from prior interventions.

Comparisons to the Great Depression (1929–1933) highlight similarities in policy-induced distortions, though the scale differs.

A focal point is the Federal Reserve's QE programs and recent overnight repo operations, which have injected record liquidity into financial markets, exacerbating dollar devaluation and market distortions.

As of January 2026, key U.S. economic indicators present a mixed but ostensibly stable picture. Real GDP growth for 2025 is estimated at 2.1% annually, with projections for 2026 ranging from 1.8% to 2.6%.

Quarterly data from the BEA shows Q3 2025 growth at 4.3% and Q2 at 3.8%, though these figures reflect post-pandemic rebounds rather than organic expansion. Unemployment stands at 4.6% as of November 2025, up slightly from 4.4% earlier in the year, indicating a softening labor market.

Inflation, measured by the Consumer Price Index (CPI), hovers at 2.7% year-over-year, with forecasts suggesting a decline to 2.4% in 2026. However, this understates real purchasing power erosion, as core inflation excluding food and energy remains elevated.

National debt exceeds $38 trillion (approximate, based on ongoing trillion-dollar deficits), far surpassing 2008 levels of around $10 trillion.

Stock markets, including the S&P 500, have reached all-time highs, buoyed by liquidity but vulnerable to corrections.

These indicators, while positive on the surface, mask widening inequality and sector-specific distress.

Consumer spending slowed in late 2025, and leading economic indices predict weakening GDP into 2026. The economy's "resilience" is artificially sustained by Federal Reserve interventions, creating a brittle structure prone to shocks.

2008 Financial Crisis

The 2008 crisis featured a 4.3% GDP contraction, unemployment peaking at 10%, and a housing market collapse that triggered global recession.

Recovery was aided by 3 QE rounds, which expanded the Fed's balance sheet from $900 billion to over $4 trillion by 2014.

In contrast, 2026's economy appears stronger superficially, with positive GDP growth and lower unemployment.

However, underlying risks are amplified as public debt is triple 2008 levels, and asset bubbles in equities and real estate exceed pre-2008 valuations.

Economists warn of a potential 2026 crash worse than 2008 due to unresolved high-interest debt and policy uncertainty.

Unlike 2008's localized banking crisis, today's issues are systemic, with QE-induced liquidity fostering dependency rather than genuine growth.

Writer’s Note: The “lower unemployment” figure comes from official numbers, but on-the-ground reporting suggests those figures may be fraudulent, meaning actual unemployment is significantly higher than the official numbers indicate. There is also substantial evidence that the positive GDP growth in 2025 has been heavily concentrated in a narrow segment of the economy, primarily AI-related investments driven by a handful of major tech companies (the “Magnificent Seven”: Apple, Microsoft, Alphabet/Google, Amazon, Meta, Nvidia, and Tesla).

The Great Depression

The Great Depression saw GDP plummet 30%, unemployment reach 25%, and deflationary spirals. Policy errors, including tight monetary policy, exacerbated the downturn.

While 2026 unemployment (4.6%) and GDP growth (2%) are far from Depression-era extremes, parallels exist in over-leveraged systems and potential for deflationary or inflationary traps.

Some analysts predict a "Depression of 2026" driven by trillion-dollar deficits and asset crashes, potentially lasting decades. The Fed's loose policies mirror the 1920s credit expansion, risking a similar bust.

Devaluation of the U.S. Dollar

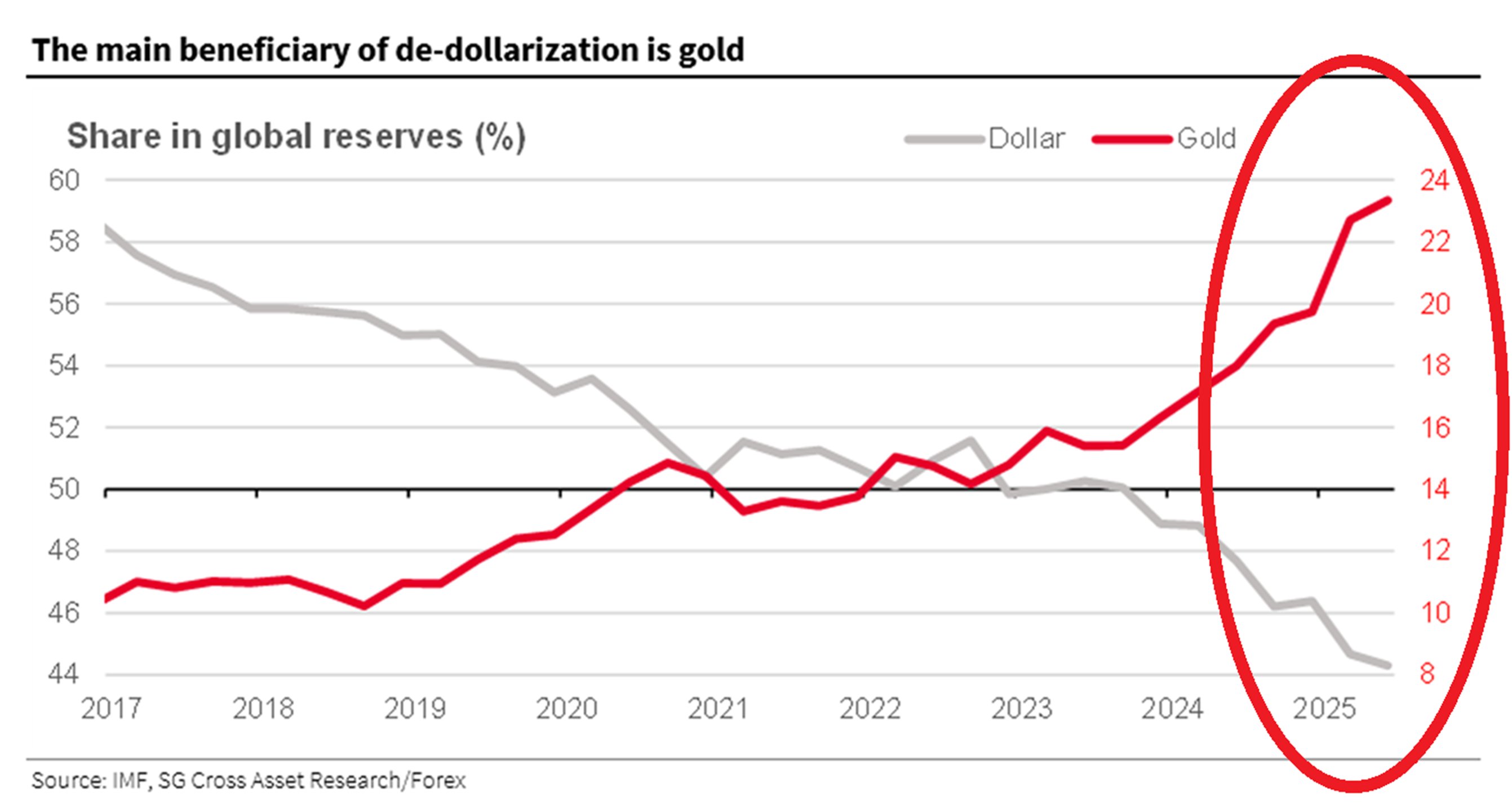

Since 2008, the Federal Reserve's QE programs have devalued the USD by flooding the system with liquidity.

M2 money supply grew from approximately $8 trillion in 2008 to $18 trillion in 2020, peaking at $22.3 trillion in November 2025, a 179% increase since 2008.

This expansion, intended to lower long-term rates and boost liquidity, has eroded purchasing power, with inflation cumulatively reducing the dollar's value by over 30% since 2008.

Poor policies, including prolonged low rates and asset purchases, have distorted markets, favoring Wall Street over Main Street. The Fed's balance sheet, now over $7 trillion, reflects ongoing QE effects, despite quantitative tightening (QT) efforts ending in 2025. This devaluation manifests in higher asset prices but stagnant wages, widening inequality.

Unprecedented Repo Injections

In the last three weeks of December 2025, the Federal Reserve injected record liquidity via overnight repos, surpassing historical levels.

On December 31, 2025, $74.6 billion was provided through the Standing Repo Facility, the highest single-day amount ever, amid year-end pressures.

Total December injections exceeded $40 billion, far outpacing pre-2008 norms and even 2019 repo spikes. These operations, while stabilizing short-term funding, indirectly support stock markets by ensuring bank liquidity, but they highlight chronic funding strains not seen in healthier economies.

This surge of more than ever before in such a short period underscores dependency on Fed support, risking moral hazard and further, rapid, dollar devaluation.

The U.S. economy in 2026 is arguably worse than in 2008 due to compounded policy errors, with QE-driven devaluation and record repo injections creating a house of cards.

While not yet matching the Great Depression's depths, the trajectory invites similar perils.

Policymakers must address root causes like excessive money creation and debt to avert catastrophe.

Kai Tutor | The Societal News Team 03JAN2026